International TransfersĪnother key difference to consider: while there is an increase in international ACH transfers, they are currently mostly limited to the USA. ACH payments, with their lower fees, are handy for smaller one-time transfers (such as to friends and family), or regular recurring payments. Use Casesīecause banks won’t clear a wire transfer unless the appropriate funds are in the sender’s account, wires are usually used for big purchases, such as down payments. If there has been a mistake in the payment amount or it was sent to the wrong account, banks will typically allow a reversal. Because of this, ACH transfers tend to be safer for senders. ReversibilityĪCH transfers are reversible ( under certain circumstances). For small person-to-person payments there is sometimes a small fee, typically around $1.

#Ach transaction deposit free

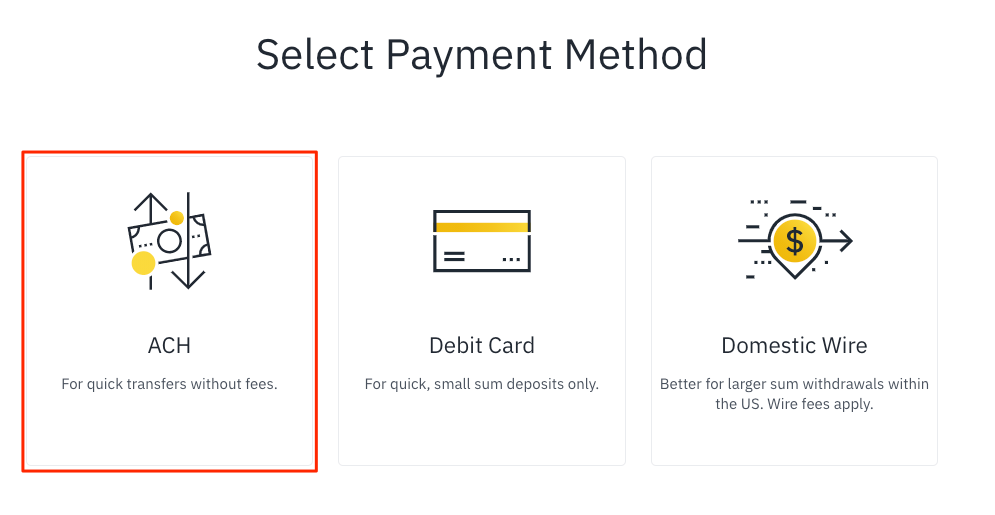

ACH transfers are usually free for both sender and receiver. Wire transfers typically cost up to $35 to send, and there are sometimes fees to receive them as well. For an additional fee, it is possible to process same-day ACH transfers. Because ACH transactions are processed in batches, they can take 3-5 business days. How long do wire transfers take to go through? They tend to be faster, with the funds appearing in the receiver’s account within one business day. One major difference is in the processing speed for transactions. However, there are some key differences between the two. a wire transfer? Both are forms of electronic transfer, meaning moving money from one bank account to another. The differences between an ACH and wire transfer This can be a one-time transaction, or you can set it up as an automated recurring transaction. Your customer’s bank makes sure there are sufficient funds in their account to make the payment, and, if so, they transfer the funds to you.Your bank/ACH provider requests the payment from your customer’s bank.

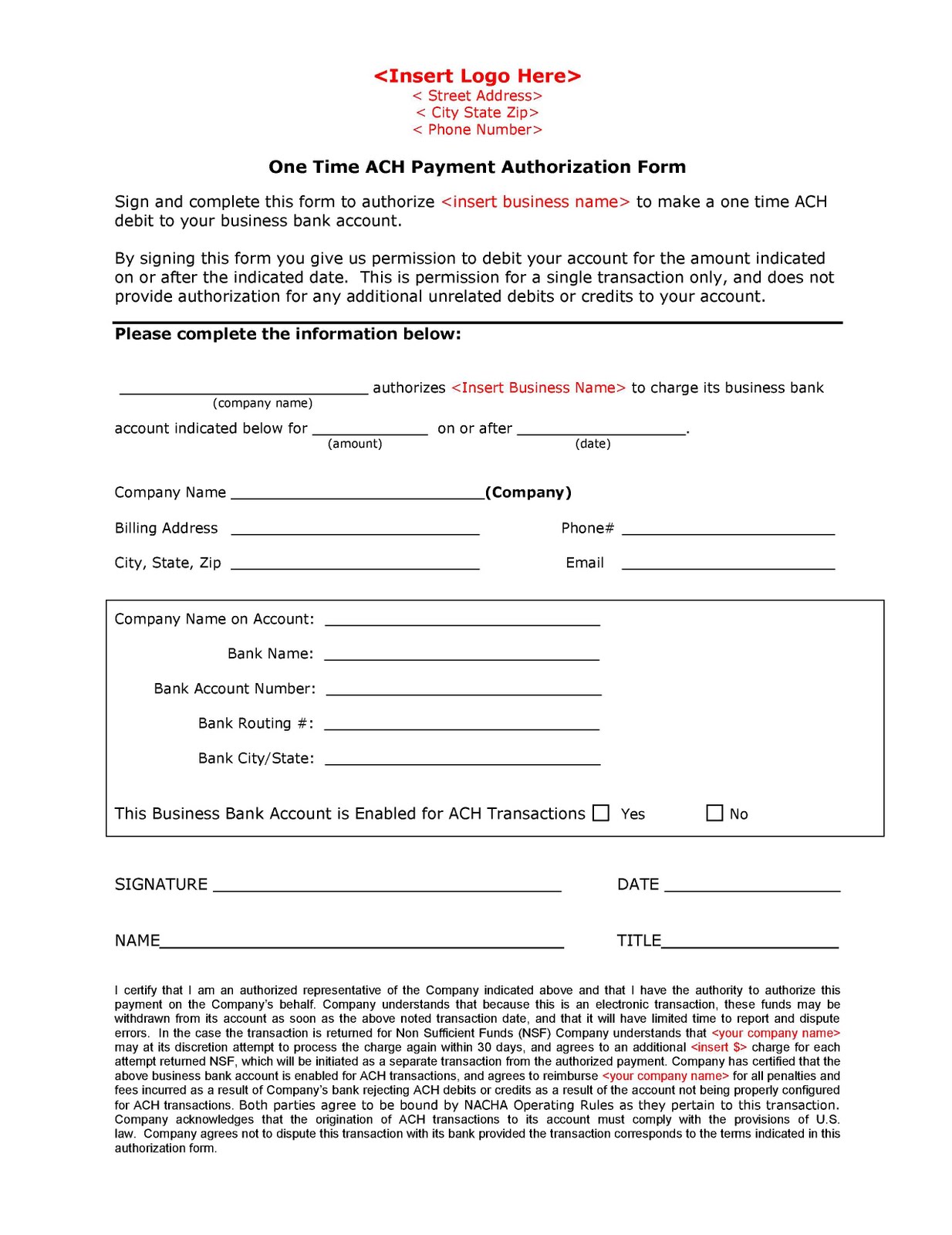

You send the transaction details to your bank or ACH provider.The customer authorizes you to retrieve funds from their account, and provides you with their banking information.This is especially convenient if the transaction is recurring, such as a monthly bill. Instead of chasing down invoices, you might prefer to withdraw funds directly from your customers’ accounts. Let’s say you’re a small business owner accepting payment for your products and/or services. They create and enforce the rules for ACH withdrawals and transfers. With authorization, funds get taken out of the sender’s account, batched with other payments through the ACH network for processing, and then, after being cleared, are deposited into the receiver’s account. The ACH Network is managed by the National Automated Clearing House Association (NACHA), which is a nonprofit made up of multiple regional payment associations. wire transfers, which we’ll address below. It’s an easy way of transferring funds in the USA, even if the sender and receiver are with different banks. It may sound very similar to a wire transfer, but there are some key differences between ACH vs. What is an ACH withdrawal?Īn ACH withdrawal is an electronic fund transfer where money is taken out of one financial account and deposited into another using the Automated Clearing House (ACH) Network. If you’ve set up your utility bills to come right out of your account, that’s an ACH withdrawal.Īs a personal user, when you send money to friends or family using any number of third-party apps such as Zelle, Venmo, or PayPal, these typically use ACH.įor a business, using ACH can be a great way of simplifying the transfer of money: setting up automated payments means you don’t have to chase down invoices or handle checks, cash, credit cards, or wire transfers. If you’ve ever received direct deposit to your checking account from an employer, that’s ACH deposit. But what is an ACH payment, and how exactly does it work? Short for “Automated Clearing House,” ACH is an electronic network that handles payments between banks. Even if you’ve never heard of ACH before, chances are, you’ve probably used it.

0 kommentar(er)

0 kommentar(er)