Some programs may even let you get the best of each by taking your short-term data and expanding it over longer periods.Īnother helpful tip is to create separate columns for your budgeted income and expenses, your actual income and expenses and the difference between them. It’s really a matter of personal preference. Some people may find a weekly budget helps them stay focused on short-term, specific goals, while others find that the wide view of annual budgets gives them clarity on their long-term habits. Your budget period can be as little as a few days and stretch all the way to several years. Monthly budgets are quite popular and might be the first thing you think of, but it might help to consider other periods too. When creating your budget spreadsheet, you’ll need to specify the period over which you’ll track your expenses. You can note which subcategories are fixed (or fairly steady, like a job salary) or variable (like stock sales or contract work).

The above concepts can also be applied to your income.

If that’s the case, you might want a program that specializes in creating graphs quickly or a template that automatically builds and updates them for you. Perhaps you’re someone who really loves charts and graphs (more on those later). Additional features: While most spreadsheets use a common cell-based organization system, some of them offer unique additional features that may be worth considering.Highly stylized templates may look cool, but can become distracting and difficult to work with from a practical standpoint.

Budget planning sheets update#

Budget planning sheets software#

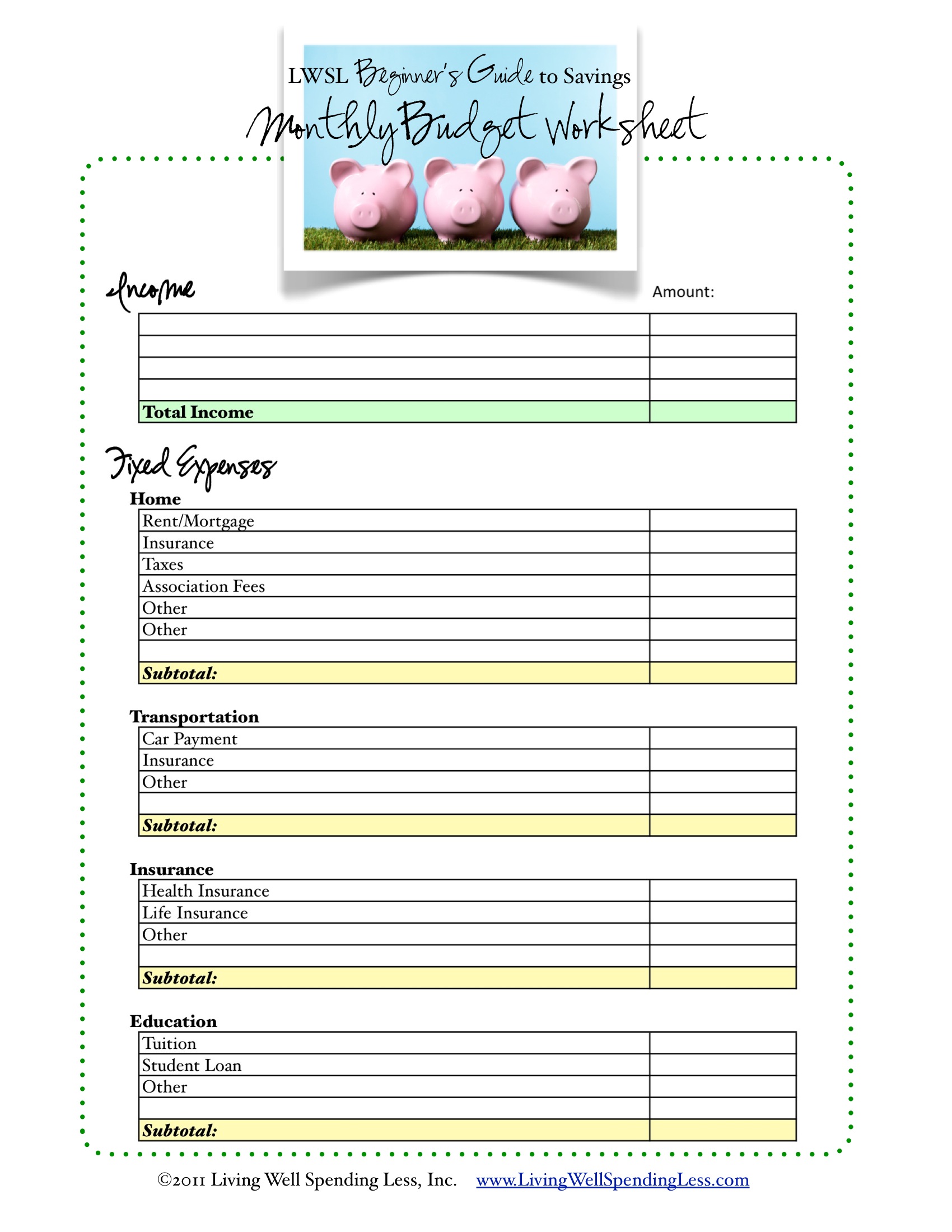

There’s a plethora of spreadsheet software to choose from, as well as several online budget planning apps. Choose a spreadsheet program or templateĪ logical starting point to building a budget spreadsheet would be to choose a program or template for this purpose. Consider visual aids and other features.ġ.Enter your numbers and use simple formulas to streamline calculations.Set your budget period (weekly, monthly, etc.).Create categories for income and expense items.Choose a spreadsheet program or template.Here are some steps that may help when building your own budget: It can help you track your income and expenses, identify areas where you might be able to save money and give you a more detailed view of your financial habits.Ĭreating an effective budget spreadsheet is often the first step toward taking greater control over your financial destiny. When it comes to managing your finances effectively, a budget spreadsheet may prove to be one of the most accessible tools in your arsenal.

0 kommentar(er)

0 kommentar(er)